Yips Globalization Drivers For Mac

The famous author and cheerleader for globalization, Thomas Friedman, in his book The World is Flat identified some key drivers of globalization. He called these factors the flatteners to denote the premise of the book that these factors were responsible for the flattening of the world. Globalization Tools provides you a simple way to globalize and localize language files based on resource file (resx). Easy to use by translators to translate all languages needed in our software.

During the last decades we saw a rapid increase of economic globalization. This fact is due to technological progress and different levels of scarcity of resources in individual countries. Sometimes it seems that the increase of cross-border exchange of goods, services, capital and other factors of production is inevitable. But as a matter of fact, the development of globalization is not determined by any laws of nature. Political decisions and institutions are central adjustment screws.

Drivers of economic globalization

Economic globalization stands for the economic interconnectedness of countries with the global economy as a whole. This interdependence relates both to the exchange of factors of production (labor, capital, technologies, know-how) and the exchange of products (material goods and services, finished and unfinished products, consumer and capital goods). In my opinion, there are three main drivers for economic globalization and its different characteristics such as trade (see figure 1), international capital markets, currency markets, migration and more:

- Demography: The size of the population of a country is important for factor endowment differences between countries. If a certain economy has a large number of workers but only a small stock of physical capital, the country is labor-abundant and capital-poor. Such a country has an international competitive advantage in manufacturing labor-intensive products. Concerning international division of labor, it will specialize on the production and export of labor-intensive products.

- Technology: Due to technical progress, costs of transportation and of communication decreased strongly during the last decades. Without these reductions of costs, phenomena such as outsourcing, long-distance trade and global value chains would not be possible.

- Political decisions: Economic processes are not operating in a political or institutional vacuum. Reducing or even eliminating barriers to trade in goods, services, labor and capital are political decisions. At the end of the day, whether economically motivated cross-border activities do actually take place or not depends on the policy frameworks in place. It is this framework which decides whether cross-border activities are facilitated, made more difficult or even completely forbidden.

Political decisions and the extent of globalization

The extent of globalization is shaped by political decisions which promote or impede economic cross-border interconnections. Just a few examples for the role of political decisions are the following:

- The decision of a country to reduce import tariffs is essential for the size and structure of international trade in goods and services. Lower barriers in trade increase the incentive to trade with other countries. This decisions is in the hand of the national government respectively parliament. In case of the European Union, these national competences are transferred to the EU. Additional trade policy instruments are bilateral or regional free trade agreements which are used in order to reduce or even eliminate tariff and non-tariff barriers to trade. The conclusion or non-completion of such an agreement is a political decision, too.

- The same applies to the decision to reduce capital controls which are used by national governments in order to regulate in inflow and outflow of capital. Closely linked to capital controls is the topic of foreign exchange controls respectively the design of foreign exchange markets (fixed versus flexible exchange rates).

- Finally, immigration regulations of individual countries are an important limitation of international migrations flows. Hence the removal of these restriction, for example within the fundamental freedoms of the European internal market, is supposed to increase cross-border migration between EU-countries.

Political decisions and the results of globalization

In addition to the shaping of globalization, political decisions are decisive factors for the way society deals with the results of globalization, especially how society wants to correct the market results produced by globalization.

In advanced economies such as the U.S, Germany, France or the United Kingdom, international trade with low-wage countries has negative effects for workers, especially for low-skilled workers. These consequences can be softened by public intervention (see figure 2). For example, if society does not feel comfortable with the distribution of market income due to globalization, taxation and transfer payments can be used in order to achieve a socially desirable distribution of net income. Other institutions which can adjust market outcomes according to preferences of society are the education system, labor market policy tools, all areas of the social security system etc.

Therefore, political decisions and institutions decide whether those persons, who suffer from the market processes in a globalized world, are finally the losers of globalization or not. In case of a strong welfare state (extensive redistribution policy, high level of protection against dismissal and more), economic and social policies could compensate the income losses of those persons who lost their job due to international competition. In that case, looking at the disposable income (= market income minus taxes minus social security contribution plus social transfers), these persons might not be classified as ‘losers of globalization’ anymore.

Limits of political influence

However, it must be pointed out that due to increasing globalization, national capacities to manage the consequences of a globalized world are limited. An impressive example of this limitation is Dani Rodrik’s trilemma of the World Economy. Because all markets need institutions, global markets require global rules, too. These rules have to be established on the global level. Hence national self-determination is violated. On the other hand, if national governments have too much power, they will apply rules and institutional arrangements according to the preferences of local population. Since preferences concerning rules and institutions are supposed to differ between countries, the result of national sovereignty is institutional heterogeneity which is not compatible with uniform global standards.

Nevertheless, even limited room for maneuvers allows national governments to shape globalization, both its extent and its consequences. If, for example, globalization has gone too far according to the preferences of a country, it is not impossible to turn back some elements of globalization. And even more important: Any government has the possibilities to change the market outcomes of globalization in its own country.

Note:

The content of this blog post is a modified pre-release of one section of my paper for the “Vision Europe Summit 2017” which will take place on 14 and 15 November 2017 in Turin. You can visit the Summit’s website by clicking here!

Related Posts:

Introduction

Wanda Cinema Line owns and operates a network of cinemas in China. The company operates 142 multiplexes in 73 towns in China. Wanda Corporation was incorporated in 2005, and the company is currently based in China. The firm also functions as a subsidiary of Dalian Wanda Group Co. Ltd. Today Wanda occupies 15 percent of box office in China and its studio number rank first in China (Johnson, 2014).

Analysis from Wanda’s acquisition of AMC

In 2012, Wanda Cinema Line decided to buy AMC Entertainment Holdings Inc. AMC for 2.6 billion dollars including debt, expanding into the United States to build the world biggest cinema ever (Johnson, 2014). The buyout, which includes about 2 billion dollars in projected debt, offers Wanda, the second-largest operator in North America where movie enthusiasts spent 10.2 billion dollars in 2013 alone. AMC is based in Missouri and is controlled by private-equity companies Apollo Global Management LLC (APO) and Bain Capital LLC, will benefit from extra $550 million investment from Wanda over time.

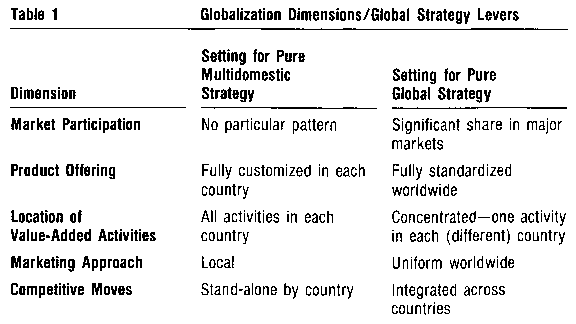

Insights from Yips globalization framework

Yips (2003) model offers insight into the forces driving globalization. Yip(2003) contends that:

The market driver includes, but are not limited to:

Analogous consumer needs and preferences

The existence of international consumers

Transferable marketing between different nations

Competitive drivers:

Competitor’s global strategies

Country interdependence

Cost drivers:

Scale of economies and product development

Favorable logistics

Country-particular differences

Government drivers

Trade policies

Local content needs: regulation over technology transfer, intellectual property, etc.

From Yips model, we see that there, is lots of proof that globalization has been growing, progressively as the 20th and 21st century first started. Even the turmoil and difficulties of the 2008 credit crunch did not hinder the process.

Insights from CAGE framework

CAGE framework was developed by Pankaj Ghemawatt to provide enterprises a manner in which to analyze countries in terms of the distance between them. Here, distance is explained extensively to consist not just the physical geographic distance between nations but also cultural, administrative and economic benefits between them. For this case, Wanda purchase of AMC shows that the multinational was interested with a market with robust consumer purchasing power, and used U.S. per capita income as their first sorting criteria. In this sense, for the consumer segment, the distance is rather great, especially on the dimensions of culture, administration and economics (Ghemawatt, 2011). Wanda chose a strategic merger with AMC who knowledge base and potential allows Wanda to better bridge the CAGE-model distances.

Wanda’s competitive advantages and disadvantages

Growing efficiencies and economies of scale accomplished through the vertical incorporation, industrial focus, and diversification though global merger with AMC gives Wand a great advantage in the competitive U.S. market. The economies of scale will include but not limited to: increase bargaining power in handling suppliers of film, equipment, and popcorn. However these do not completely justify a peak market price in the cinema chain. Other key aspects include trans-nationalization of ownership, global spread of production and the freelance market for creative and craft labor. The other competitive advantage for Wanda is the existing huge and wealthy home market that permits the industry to earn a considerable part of its investment in its own zone. The growing significance of global markets for AMC international turnover; presently, between 40% and 60% of AMC’s theatrical grosses come from the global market. Accordingly, Wanda has underpinned its appeal to foreign audiences via the importation of foreign talent and the ostensible “blockbusting” productions. In relation to the above point, large marketing and distribution costs, both in local and foreign markets, and important market research so as to accomplish productive marketing campaigns is another competitive advantage for Wanda in the U.S. film industry. Movie as a multiplatform product, focused on high perception aspects and with franchise capability. An AMC movie is no longer just a film, but also commodity appropriate for sorts of commercial windows. In this view, the AMC/Wanda will essentially remain in the business of exploiting intellectual property rights. However, uncertain trade operations and regulations by United States distributors in global distribution and exhibition agreements could give Wanda a competitive disadvantage. Other than abusive demands in sharing box office profits in cases such as blockbusters have limited exhibitors’ liberty by overlying in contracts regarding mechanism of liquidation, pricing, collection, amid other things (Hoskins & McFadyen, 2011).

Discussion

Wanda is experiencing the reality the restricted although still dominant appeal of its films and the increasing popularity of domestic films across the globe. However, as opposed to fighting against competition, Wanda has joined it, determined to engage in partnering with domestic productions. At the distribution level, Wanda seeks to underpin its position in U.S. distribution markets via merger with the local distributor AMC, with a view to capitalizing revenues whist evading quotas and restrictions. In essence the idea behind the presence of Wanda in U.S. is to spread culture and share happiness among the growing Chinese Diasporas. Wanda also moves to apply foreign talent when it can, drawing budding actors and directors from across the globe to work on its projects. AMC/Wanda presence in European production and distribution permits them to establish promising talents that they can integrate into Wanda Cinema Line system. It can as well be said Wanda seeks to produce some of its movies for economic (tax incentives and lower labor costs), creative (exotic locations) and even marketing concerns while considering the hypermobility of today’s film production (Balio, 2005).

Advancement toward the globalization of production and trade has been rapid in recent years. In spite of the volatility in economic expansion, the past two decades have seen huge increased in global grosses and in levels of global business in both commodities and services (Hartungi, 2006). By purchasing AMC, Wand Cinema Line only sees a development opportunity in film and a good return on investment with a Chinese growth kicker in the U.S. If there were competitive advantages to becoming a huge international player in the film industry, some corporations would have done it before. Size alone and international dimension does not provide visible strategic advantages in an enterprise whose movie-going consumers are purely domestic ones. The AMC acquisition may be the catalyst for Wanda to transfer a huge sum of monies from “soft” Chinese currency into hard American greenbacks. Theaters on the other hand are a cash enterprise, and Wanda could finally AMC community, which would be a shrewd way for the firm to shift a chunk of its assets base and increase it in the relatively safe haven of the United States.

References

Ghemawatt, P. (September 2011). “Distance Still Matters,” Harvard Business Review. Retrieved from:http://sabanet.unisabana.edu.co/postgrados/finanzas_negocios/Homologacion/negoc iosint/Distance%20still%20matters.pdf.> [Accessed 7 December 2015]

Hartungi, R. (2006). ‘‘could developing countries take the benefit of globalization?’’, International Journal of Social Economics, Vol. 33 No. 11, pp. 728-43.

Yips Globalization Drivers For Mac Windows 7

Hoskins, C. and McFadyen, S. (2011), ‘‘The US competitive advantage in the global television market: is it sustainable in the new broadcasting environment?’’, Canadian Journal of Communication, Vol. 16(2), pp. 207-24.

Hoskins, C. and Mirus, R. (2008), ‘‘Reasons for the US dominance of the international trade in television programs’’, Media, Culture and Society, Vol. 10, pp. 499-515.

Aaker D.A. (2008). Developing Business Strategies. New York: John Wiley.

Balio, T. (2005). The American Film Industry. Wisconsin: The University of Wisconsin Press.

Currah, A. (2007). “Hollywood, the Internet and the World: A Geography of Disruptive Innovation”, Industry and Innovation, vol. 14 no. 4: 359-383.

Donahue, S .M. (2007). American film distribution: The changing marketplace. Ann Arbor: University of Michigan press..

Yips Globalization Drivers For Macbook Pro

Barnes, B. (2011). “Chinese Film Industry and Movie Business: Facts and Details,” American Journal of Management, 12(24), pp. 67-69.